The Expert Guide to Retail Planning

Strengthen your retail planning capabilities by understanding the processes, leading practices, challenges, and supporting technology.

Retail planning is a term that is widely used across a number of different intricate and related processes, but in the broadest sense, the objective of retail planning is to determine what, how much, and where a retailer intends to sell during a given timeframe while maximizing return on investment (ROI).

Retail planning consists of several interrelated activities typically performed by merchants and/or planners within a retail organization. Although it may seem like a linear process, in many cases the different planning processes are performed simultaneously based on where a retailer is in their calendar.

Many retail planning activities are supported by demand forecasting, which involves plan seeding and takes into account sales revisions related to trends or promotions, or changes in consumer shopping habits.

This article will provide a high-level overview of each of the retail planning processes along with links to Parker Avery’s expert guides, which take a deep dive into each area.

Retail Planning Activities

A typical cadence of retail planning activities includes:

- Strategic planning

- Merchandise financial planning (MFP)

- Assortment planning (AP)

- Item planning (IP)

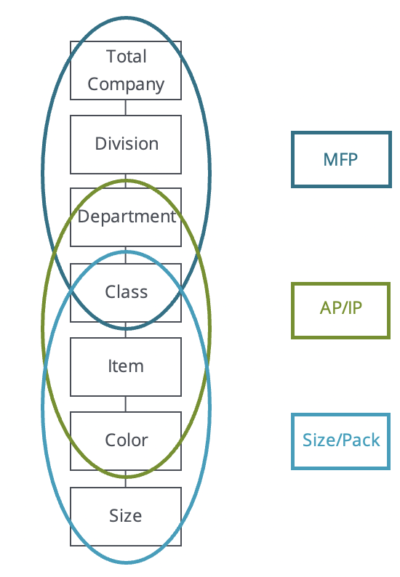

Size profiling and pack optimization may be included based on the organization and product characteristics. Each of these activities or processes takes place at a different level in the product hierarchy, although there is quite a bit of overlap.

Sample Retail Product Hierarchy

What is a product hierarchy?

A product hierarchy is how retailers organize products to facilitate retail planning activities, manage products for operations, and monitor performance.

There can be alternate hierarchies within one retailer, depending on the business model and how the hierarchy is used. For example, a grocery store might put milk in the dairy class of the refrigerated department. An online store might put a lamp under the furniture department and either the office furniture or accessories class.

Some organizations may also have an alternate hierarchy related to product ownership (a people hierarchy). Alternates are most often used in reporting to keep planning simple. Product hierarchies help retailers organize their inventory and make it more accessible to plan, find, track, and sell.

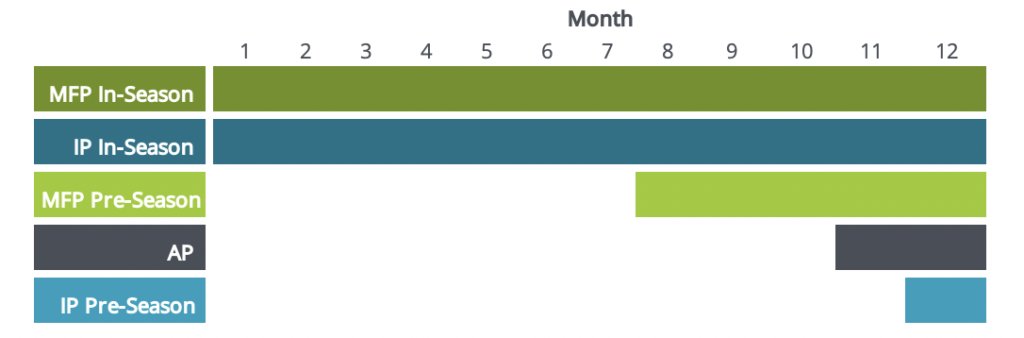

Retail Planning Calendar

The below sequence and timing provide an example of a tops down approach, with each step going into a lower level of detail in the product hierarchy. However, some retailers may start with assortment planning if they have long lead times to design, manufacture, and receive products. We have seen clients that start with the following year’s assortment planning in May of the current year. In this scenario, the assortment plans still need financial guidance, even if the MFP is not fully complete.

Strategic Planning

Strategic planning is the process where senior leadership outlines the high-level goals for the next season or year. Often, retailers create a rolling three-year plan (3YP) that is updated as time elapses. This strategic plan typically includes product strategies, location strategies, profit targets, sales goals, and marketing strategies, among other activities. Strategic planning typically kicks off or is needed to support any integrated business planning (IBP) efforts.

The retailer’s strategic plan provides direction to the merchant and planning team as input into creating more detailed plans (e.g., MFP, assortment, item). In more sophisticated organizations, strategic planning is typically a formal process (e.g., performed using financial systems and real estate systems). However, in some retailers, strategic planning is done less formally, employing spreadsheets, whiteboards, and even paper. In our experience, the size and maturity of the retail organization have little to do with the use of the formality of its strategic planning process.

Merchandise Financial Planning

Merchandise financial planning (MFP) is a key process managed by planners or merchants and is essentially a seasonal checkbook providing guidance on how much money can be spent on inventory.

MFP is both a pre-season and in-season process, typically managed in a formal application or using spreadsheets. Pre-season, budgets are created for sales, receipts, inventory, and margin at a common level of the product hierarchy (department/category or class based on the size of the organization).

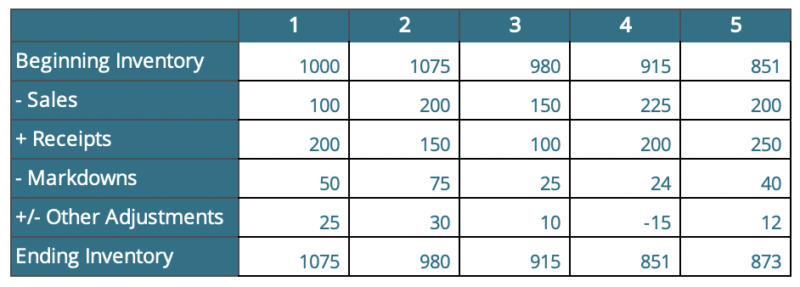

Here is a simple illustration of the measures and calculations that may be found in MFP for a department of products:

Note that one period’s ending inventory flows to be the following periods beginning inventory. Some retailers may perform MFP at a weekly level, while others may choose to plan monthly. The cadence depends on the company’s ability to quickly react to their business and the rate of sales of the products.

Assortment Planning

At a high level, assortment planning (AP) outlines what products a retailer will sell in what locations and channels. Assortment planning includes defining financial targets for a specific time period at more detailed levels of the product hierarchy. These targets are then tied to an overall merchandising strategy. As a result, assortment planning often includes both assortment creation and item planning, inclusive of both carryover products and placeholders for new products.

However, there still may be other functions of the assortment plan depending on the organization and its planning cadence and expertise. AP may, for instance, be used to quantify purchases for each item or even help determine the amounts of inventory to be distributed to each store as well as held back for replenishment or direct sales.

The assortment plan considers the retailer’s financial objectives and seasonality of merchandise to ensure proper receipt flow and product range. Outputs of assortment planning include initial purchase quantities and the receipt flow across time that will inform the allocation and replenishment processes. The level of detail in the assortment planning process will also differ depending on the type of product being planned.

Item Planning

Item planning (IP) is a process that focuses more granularly on the item/item color level of the product hierarchy. Typically managed by planners or merchants, item planning essentially plans the flow of sales, receipts, and inventory over time. IP is both a pre-season and in-season process, typically managed in a formal application or in spreadsheets.

For a given planning season or period, item planning begins once MFP and AP have been completed. Key item planning measures (like those in MFP) are spread over time.

Pre-season, budgets are created for sales, receipts, inventory, and margin at the item or item/color level of the product hierarchy. In-season, actual performance is compared to planned values and adjusted to reflect sales trends, receipt timing, potential promotions, and potential clearance/markdown candidates. If items are performing better than expected, reorders may be placed to refresh the inventory. Also, future sales projections may be adjusted to reflect updated demand forecasts.

Size Profiling

Size profiling is an analytical process where historical data is used to identify consumer preferences with regard to apparel size. Depending on the organization, size profiling may be performed by merchants, planners, or a dedicated team of analysts. Size profiling can be done at various levels of the product and location hierarchy based on the maturity of the organization and its capacity to perform at more granular levels of detail. The lower the levels of detail, the differences in the sizes can vary.

Anecdotally, retailers will say that sizes run larger in the Midwest and smaller on the West Coast. Performing size profiling can prove or disprove the theories of what sizes are more popular.

Size Profiling Example

A simple example of size profiling for t-shirts could be the following:

| T-Shirt Size | XS | S | M | L | XL |

|---|---|---|---|---|---|

| Total | 18% | 20% | 22% | 25% | 15% |

However, when broken down by color, the distribution may vary:

| T-Shirt Size | XS | S | M | L | XL |

|---|---|---|---|---|---|

| White | 20% | 21% | 22% | 25% | 12% |

| Black | 15% | 18% | 22% | 25% | 20% |

Further breaking size profiling down by region/location may provide even different weights by size.

Ultimately, size profiles would be applied to the receipts planned in item planning by breaking down the total quantities of an item/color into sizes to create a purchase order. It is important to keep in mind that it is easy to get lost in the analytic details, so be sure to keep the size profiling process simple but meaningful. This is especially true for more complicated sizing, such as pants/jeans (waist, inseam), or men’s dress shirts (neck, arm length). Advanced analytics can take on some of the heavy lifting, by churning through mass quantities of data and producing statistical recommendations on size profiles.

Size profiles are also used to create packs if a retailer decides to order them.

Pack Optimization

Packs, or pre-packs, are a predetermined ‘run’ of sizes that are prepared by a supplier and shipped together. Based on the size profiles, these packs are created by merchants, planners, or allocators so they can be efficiently shipped to stores and avoid picking and packing done in a warehouse.

Pack Optimization Example

Using the above size profile for white and black t-shirts, desiring a pack of 12 units in white and 10 units in black, the following units would be assigned to each pack.

| T-Shirt Size | XS | S | M | L | XL | Pack Size |

|---|---|---|---|---|---|---|

| White | 2 | 3 | 3 | 3 | 1 | 12 |

| Black | 2 | 2 | 2 | 2 | 2 | 10 |

In this case, a store assigned a pack of white would receive a packet of 12 units with the predefined sizes. The warehouse would only have to send one pack with 12 units instead of picking 12 units from different bins and packing them to ship to a store.

Where this starts to become more complex is if every location cannot afford to receive 12 units of white either due to space or budget constraints. If we have a pack of 12 units in white and another of 8 units in white, the pack definition may (mathematically) result in the following:

| T-Shirt Size | XS | S | M | L | XL | Pack size |

|---|---|---|---|---|---|---|

| White | 2 | 3 | 3 | 3 | 1 | 12 |

| Black | 2 | 2 | 2 | 2 | 0 | 8 |

At this point, the business would need to decide if having zero units of XL in the pack is ideal, and, if not, from which size they would need to shift a unit.

Where the pack optimization comes into play is if the merchant plans to purchase 600 units of white, a systemic calculation would determine how many of each pack should be purchased to get as close to the 600 units possible. This analysis uses an intersection of location need, location affinities for specific sizes, and location budget (among other factors).

Packs are not limited to sizes; they can also be flavors, colors, or other attributes. As an example, if a merchant is purchasing 12 flavors of jelly, they may want to use the following pack to distribute to the stores based on consumer preferences:

| Grape | Strawberry | Raspberry | Blackberry | Pack size |

|---|---|---|---|---|

| 4 | 4 | 2 | 2 | 12 |

Remember that this section provides a high-level overview by providing a basic description of packs and optimization. Other aspects to consider include ordering quantities in bulk that stay in the warehouse to replenish stores as products are sold or changing demographics that would shift the size profiles by location. Further, using advanced analytics and artificial intelligence supports both size and pack optimization processes and results in tremendous inventory efficiencies.

Retail Planning Systems

The end-to-end retail planning processes are complex and data-heavy. Particularly in large, global retailers, performing retail planning manually or using home-grown, interrelated spreadsheets often results in miscommunications, lack of alignment between business units, and poor results. Retailers increasingly employ advanced analytics throughout their planning processes, and spreadsheets simply cannot leverage those innovations. Further, across the different planning processes, it is difficult, if not impossible, to achieve ‘one version of the truth’ using spreadsheets. Despite these shortcomings, and regardless of size or maturity, many retailers continue to use a combination of spreadsheets for some planning processes.

However, we are seeing strong interest from Parker Avery clients in implementing packaged solutions where spreadsheets cannot provide the necessary analytics, visibility, or collaborative functionality across retail planning processes. Formal, packaged solutions have begun to evolve retail planning into a science-based activity through the use of advanced analytics, artificial intelligence, and reinforcement learning. Using these systems, retail planning processes can leverage future-focused demand forecasts (instead of relying on historical data only) and leading practices.

When evaluating retail planning solutions, some companies elect to employ all capabilities provided by a single vendor, while others choose a best-of-breed approach, with multiple point-to-point solutions. We anticipate this difference will continue, as retail planning system functionality will likely never be a ‘one-size-fits-all’ approach.

However, we highly recommend retailers explore the innovations provided by modern retail planning systems. By reducing the manual effort required to complete retail planning activities, the business can turn its focus from gathering data, managing multiple spreadsheets, and generating reports to analyzing the business performance and making strategic, science-driven, informed decisions.

You may also like